May 2, 2021 — Even in the midst of economic turmoil, tax-exempt bond financing fared well in 2020. New legislation and a recovering economy promise to keep the momentum going.

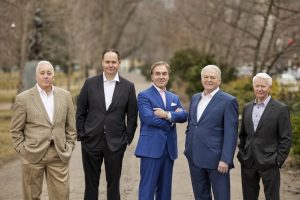

The Boston Capital Finance executive team (left to right): Director of asset management and underwriting Bill Fazzano; director of investor relations and originations Sean Curry; founder, principal, and CEO Jack Manning; managing partner and principal Kevin Costello; and director and Boston Capital consultant Don Phelan.

Boston Capital Finance (BCF) executives recently shared their insight on how the events of the past year—including December 2020 legislation that established a minimum 4% low-income housing tax credit rate—will affect bond financing. BCF is uniquely qualified to address the topic. The company’s origins stretch back to 1974, when Jack Manning co-founded Boston Capital, BCF’s parent company. In 1994, Manning and Kevin Costello added debt originations to its syndication business, a move that turned it into a major finance player. The company sold the syndication operation last year, which allowed it to focus on lending and finance.

What impact will the recent legislation have over the next five to 10 years?

It will continue to drive affordable developers toward tax-exempt bond multifamily developments. Many states are already hitting their bond cap allocation limits. One result is that more affordable units will get built. That’s great for the industry. But it’s also great for the country, given the need for affordable housing.

What surprised you most about 4% tax-exempt bond financing in 2020?

We’ve always been impressed with the affordable housing field’s resilience. Last year was a difficult environment for everyone. But the asset class continued to outperform others, and our 4% tax-exempt bond platform was busier than ever.

How does that compare to the last five years?

Five years ago, we were doing a lot of forward permanent bond purchases. The business has moved toward a single bond closing, which includes both the construction and permanent phase of the financing. That saves developers time and money because they can deal with one firm that offers both. A company like BCF can offer a certainty of delivery by controlling both sides of the financing.

Did the last year change how you approach your business?

Like most companies, we dove into using remote-based technologies. We were pleased with how our team embraced these different modes of communication—and with how they helped boost our productivity.

Many economists predict interest rates will rise soon. What does that mean for the affordable housing development industry?

It’s impossible to predict where rates will settle, but that doesn’t mean you shouldn’t prepare. If they start climbing, an early rate-lock might be a good strategy. We see the economy accelerating. And that typically leads to higher interest rates and higher construction prices, so it may not be the best approach to wait and see how it plays out. We recommend using a nimble financing team to help you close quickly. In a similar vein, the developer’s choice of a finance structure will be equally critical. A seasoned underwriting team—one that’s been through multiple market cycles—can be a huge help.

Explore financing solutions at https://bostoncapital.com/for-investors/affordable-housing/mortgage-funds/