A Proactive Approach

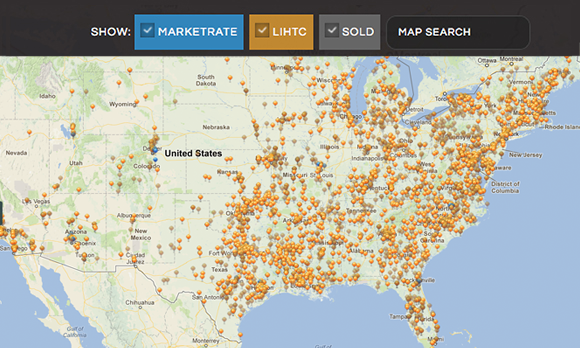

Boston Capital’s Dispositions Group’s innovative approach to selling LIHTC properties beginning in 2001 helped establish an active market for tax credit properties and interests. We have become an industry leader and our knowledgeable staff is frequently asked to provide expertise on a national stage as well as to individuals seeking guidance on property sales.

We are responsible for the sale of Boston Capital’s investors’ interests in LIHTC assets and the orderly liquidation of its portfolio. Typically, property dispositions occur after the expiration of the 15-year LIHTC compliance period. However, dispositions may occur at any time after the expiration of the 10-year credit period if the sale is in the best financial interests of Boston Capital’s investors.

Dispositions are often guided by the relationship between the local general partner and the management company. This relationship directly affects the disposition model employed, and the manner of disposition is a function of the asset and property type. We work closely with BC Asset Management to recognize opportunities for capital distributions and to develop relationships to the investors’ advantage. Following this proactive approach, sales in excess of 100 properties/limited partnership interests are expected to close in each of the next three years.